During the Covid 19 era, operational risks have escalated above the acceptable risk appetite level for most organizations. It has become a challenge for the financial sector to manage risks such as human error, failure in internal and external processes resulting from their operations due to the increase in the number of employees working remotely. Apart from internal and external processes, employees are also the major contributors to operational risks. The Basel II, however, defines operational risk as the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events.

Because operational risks are multiplying, and regulations have become more exacting, no organization can afford to be complacent. Financial institutions must embed risk management in their cultures and evolve to meet new needs. They must develop appropriate risk management tools and knowledge and create frameworks and policies to ensure both compliance and resilience.

To effectively manage operational risks resulting from human error, internal and external processes. Employees need to be adequately trained in operational risk management so that they are well equipped to bring down the operational risk below an acceptable risk appetite level.

Digital Safe Limited in conjunction with Chapelle consulting Through PECB, Will be conducting certification training in Operational Risk Management (ORM).

Who should attend?

Chief risk officers, Heads of operational risk, Risk directors, Risk Managers, risk officers, risk analysts, business line managers in charge of managing their risks, senior managers and managers who seek guidance on operational risk management, compliance officers, internal auditors, regulators, consultants, professional interested in advancing their careers in operational risk management.

- Understand the regulatory requirements and best practices of operational risk management in the financial services

- Learn how to establish and operate an operational risk management framework in the context of a financial organization

- Understand the approaches, methods, and tools to identify, assess, mitigate, and monitor operational risk in the financial services industry

- Understand core components of the course curriculum, including: ORM framework, regulatory context, risk appetite, risk assessment, incident data collection, key risk indicators, risk culture, scenario analysis, capital assessment, and reputation risk.

This certification is aimed at those who are:

- Designed and delivered by leading experts in the field, the ORM Certification course provides the knowledge and references that professionals need to enter, manage and lead the operational risk discipline in financial services.

- The qualified trainers, course content and related exams help professionals acquire and demonstrate the skills and ability to execute their function effectively and gain professional recognition in the field.

- These qualifications will give you exceptional knowledge and increase your professional standing in the market.

Training Content

Operational risk management training is a three-day program with detailed and practical insight into operational risk. The first day covers the regulatory context and risk governance including frameworks, policies, and risk appetite. Further, the second and third day covers interesting operational risk domain such as incident data collection, risk and control self-assessment, risk culture, and key risk indicators.

Date: 20th February 2023 – 22nd FEBRUARY 2023 at

Location: The Quorum.

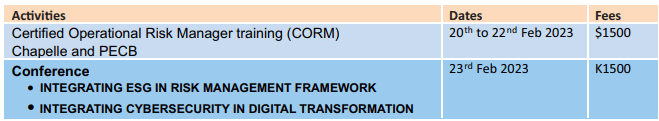

The cost of the certification training in operational risk and the conference is as follows:

Once payments are made send the POP or for further information contact Elias Mpofu or Sunata Mvula on:

Elias Mpofu

Phone: +26095500191

Email: elias.mpofu@digitalsafezm.com

Sunata Mvula

Phone: +260977527688

Email: suna.mvula@digitalsafezm.com